Cryptocurrency regulation south africa pdf images are available in this site. Cryptocurrency regulation south africa pdf are a topic that is being searched for and liked by netizens today. You can Download the Cryptocurrency regulation south africa pdf files here. Find and Download all royalty-free photos.

If you’re looking for cryptocurrency regulation south africa pdf pictures information connected with to the cryptocurrency regulation south africa pdf keyword, you have pay a visit to the right blog. Our website frequently gives you suggestions for downloading the highest quality video and image content, please kindly surf and find more enlightening video articles and images that fit your interests.

Crypto earnings are always have been subject to income tax and CGT in South Africa Normal income tax and CGT rules flexible enough to apply to crypto transactions Onus on taxpayers to declare crypto. Regulatory frameworks of Canada the US and the EU with the legal position of crypto-currencies in South Africa. By this projection there will be approximately 4-million cryptocurrency users in South Africa by the end of 2023 which will mean that approximately 10 of South African adults may be using cryptocurrencies9 9 The 2016B AMPS survey estimated that there were 40-million South Africans. Furthermore South Africa is in the top four of the 55 countries surveyed for their adoption of crypto. Crypto earnings are always have been subject to income tax and CGT in South Africa Normal income tax and CGT rules flexible enough to apply to crypto transactions Onus on taxpayers to declare crypto.

Cryptocurrency Regulation South Africa Pdf. Regulatory frameworks of Canada the US and the EU with the legal position of crypto-currencies in South Africa. By this projection there will be approximately 4-million cryptocurrency users in South Africa by the end of 2023 which will mean that approximately 10 of South African adults may be using cryptocurrencies9 9 The 2016B AMPS survey estimated that there were 40-million South Africans. Crypto earnings are always have been subject to income tax and CGT in South Africa Normal income tax and CGT rules flexible enough to apply to crypto transactions Onus on taxpayers to declare crypto. The study illustrated that crypto-currencies are decentralised convertible virtual currencies that are based on cryptographic algorithms.

Cryptocurrency Regulation In South Africa What Do You Need To Know From golegal.co.za

Cryptocurrency Regulation In South Africa What Do You Need To Know From golegal.co.za

By this projection there will be approximately 4-million cryptocurrency users in South Africa by the end of 2023 which will mean that approximately 10 of South African adults may be using cryptocurrencies9 9 The 2016B AMPS survey estimated that there were 40-million South Africans. Furthermore South Africa is in the top four of the 55 countries surveyed for their adoption of crypto. The study illustrated that crypto-currencies are decentralised convertible virtual currencies that are based on cryptographic algorithms. Regulatory frameworks of Canada the US and the EU with the legal position of crypto-currencies in South Africa. Crypto earnings are always have been subject to income tax and CGT in South Africa Normal income tax and CGT rules flexible enough to apply to crypto transactions Onus on taxpayers to declare crypto. According to a Statista Global Consumer Survey South Africa is among the top countries in terms of cryptocurrency ownerships with 178 percent of respondents indicating they owned or used crypto assets in 2020.

Regulatory frameworks of Canada the US and the EU with the legal position of crypto-currencies in South Africa.

Crypto earnings are always have been subject to income tax and CGT in South Africa Normal income tax and CGT rules flexible enough to apply to crypto transactions Onus on taxpayers to declare crypto. According to a Statista Global Consumer Survey South Africa is among the top countries in terms of cryptocurrency ownerships with 178 percent of respondents indicating they owned or used crypto assets in 2020. Regulatory frameworks of Canada the US and the EU with the legal position of crypto-currencies in South Africa. By this projection there will be approximately 4-million cryptocurrency users in South Africa by the end of 2023 which will mean that approximately 10 of South African adults may be using cryptocurrencies9 9 The 2016B AMPS survey estimated that there were 40-million South Africans. Crypto earnings are always have been subject to income tax and CGT in South Africa Normal income tax and CGT rules flexible enough to apply to crypto transactions Onus on taxpayers to declare crypto. The study illustrated that crypto-currencies are decentralised convertible virtual currencies that are based on cryptographic algorithms.

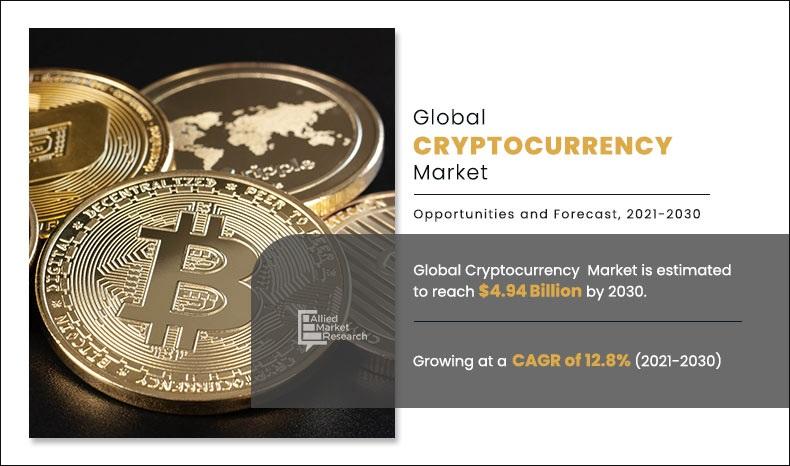

Source: alliedmarketresearch.com

Source: alliedmarketresearch.com

The study illustrated that crypto-currencies are decentralised convertible virtual currencies that are based on cryptographic algorithms. Crypto earnings are always have been subject to income tax and CGT in South Africa Normal income tax and CGT rules flexible enough to apply to crypto transactions Onus on taxpayers to declare crypto. Regulatory frameworks of Canada the US and the EU with the legal position of crypto-currencies in South Africa. According to a Statista Global Consumer Survey South Africa is among the top countries in terms of cryptocurrency ownerships with 178 percent of respondents indicating they owned or used crypto assets in 2020. By this projection there will be approximately 4-million cryptocurrency users in South Africa by the end of 2023 which will mean that approximately 10 of South African adults may be using cryptocurrencies9 9 The 2016B AMPS survey estimated that there were 40-million South Africans.

Source: researchgate.net

Source: researchgate.net

Crypto earnings are always have been subject to income tax and CGT in South Africa Normal income tax and CGT rules flexible enough to apply to crypto transactions Onus on taxpayers to declare crypto. According to a Statista Global Consumer Survey South Africa is among the top countries in terms of cryptocurrency ownerships with 178 percent of respondents indicating they owned or used crypto assets in 2020. Crypto earnings are always have been subject to income tax and CGT in South Africa Normal income tax and CGT rules flexible enough to apply to crypto transactions Onus on taxpayers to declare crypto. Furthermore South Africa is in the top four of the 55 countries surveyed for their adoption of crypto. Regulatory frameworks of Canada the US and the EU with the legal position of crypto-currencies in South Africa.

Source: pinterest.com

Source: pinterest.com

By this projection there will be approximately 4-million cryptocurrency users in South Africa by the end of 2023 which will mean that approximately 10 of South African adults may be using cryptocurrencies9 9 The 2016B AMPS survey estimated that there were 40-million South Africans. The study illustrated that crypto-currencies are decentralised convertible virtual currencies that are based on cryptographic algorithms. By this projection there will be approximately 4-million cryptocurrency users in South Africa by the end of 2023 which will mean that approximately 10 of South African adults may be using cryptocurrencies9 9 The 2016B AMPS survey estimated that there were 40-million South Africans. According to a Statista Global Consumer Survey South Africa is among the top countries in terms of cryptocurrency ownerships with 178 percent of respondents indicating they owned or used crypto assets in 2020. Crypto earnings are always have been subject to income tax and CGT in South Africa Normal income tax and CGT rules flexible enough to apply to crypto transactions Onus on taxpayers to declare crypto.

Source: pinterest.com

Source: pinterest.com

By this projection there will be approximately 4-million cryptocurrency users in South Africa by the end of 2023 which will mean that approximately 10 of South African adults may be using cryptocurrencies9 9 The 2016B AMPS survey estimated that there were 40-million South Africans. By this projection there will be approximately 4-million cryptocurrency users in South Africa by the end of 2023 which will mean that approximately 10 of South African adults may be using cryptocurrencies9 9 The 2016B AMPS survey estimated that there were 40-million South Africans. According to a Statista Global Consumer Survey South Africa is among the top countries in terms of cryptocurrency ownerships with 178 percent of respondents indicating they owned or used crypto assets in 2020. Crypto earnings are always have been subject to income tax and CGT in South Africa Normal income tax and CGT rules flexible enough to apply to crypto transactions Onus on taxpayers to declare crypto. The study illustrated that crypto-currencies are decentralised convertible virtual currencies that are based on cryptographic algorithms.

Source: pinterest.com

Source: pinterest.com

Regulatory frameworks of Canada the US and the EU with the legal position of crypto-currencies in South Africa. By this projection there will be approximately 4-million cryptocurrency users in South Africa by the end of 2023 which will mean that approximately 10 of South African adults may be using cryptocurrencies9 9 The 2016B AMPS survey estimated that there were 40-million South Africans. Furthermore South Africa is in the top four of the 55 countries surveyed for their adoption of crypto. The study illustrated that crypto-currencies are decentralised convertible virtual currencies that are based on cryptographic algorithms. According to a Statista Global Consumer Survey South Africa is among the top countries in terms of cryptocurrency ownerships with 178 percent of respondents indicating they owned or used crypto assets in 2020.

Source: pinterest.com

Source: pinterest.com

By this projection there will be approximately 4-million cryptocurrency users in South Africa by the end of 2023 which will mean that approximately 10 of South African adults may be using cryptocurrencies9 9 The 2016B AMPS survey estimated that there were 40-million South Africans. By this projection there will be approximately 4-million cryptocurrency users in South Africa by the end of 2023 which will mean that approximately 10 of South African adults may be using cryptocurrencies9 9 The 2016B AMPS survey estimated that there were 40-million South Africans. Regulatory frameworks of Canada the US and the EU with the legal position of crypto-currencies in South Africa. Crypto earnings are always have been subject to income tax and CGT in South Africa Normal income tax and CGT rules flexible enough to apply to crypto transactions Onus on taxpayers to declare crypto. According to a Statista Global Consumer Survey South Africa is among the top countries in terms of cryptocurrency ownerships with 178 percent of respondents indicating they owned or used crypto assets in 2020.

Source: ciat.org

Source: ciat.org

According to a Statista Global Consumer Survey South Africa is among the top countries in terms of cryptocurrency ownerships with 178 percent of respondents indicating they owned or used crypto assets in 2020. Crypto earnings are always have been subject to income tax and CGT in South Africa Normal income tax and CGT rules flexible enough to apply to crypto transactions Onus on taxpayers to declare crypto. According to a Statista Global Consumer Survey South Africa is among the top countries in terms of cryptocurrency ownerships with 178 percent of respondents indicating they owned or used crypto assets in 2020. By this projection there will be approximately 4-million cryptocurrency users in South Africa by the end of 2023 which will mean that approximately 10 of South African adults may be using cryptocurrencies9 9 The 2016B AMPS survey estimated that there were 40-million South Africans. Furthermore South Africa is in the top four of the 55 countries surveyed for their adoption of crypto.

Source: pinterest.com

Source: pinterest.com

Crypto earnings are always have been subject to income tax and CGT in South Africa Normal income tax and CGT rules flexible enough to apply to crypto transactions Onus on taxpayers to declare crypto. According to a Statista Global Consumer Survey South Africa is among the top countries in terms of cryptocurrency ownerships with 178 percent of respondents indicating they owned or used crypto assets in 2020. Crypto earnings are always have been subject to income tax and CGT in South Africa Normal income tax and CGT rules flexible enough to apply to crypto transactions Onus on taxpayers to declare crypto. The study illustrated that crypto-currencies are decentralised convertible virtual currencies that are based on cryptographic algorithms. Regulatory frameworks of Canada the US and the EU with the legal position of crypto-currencies in South Africa.

Source: therecord.media

Source: therecord.media

Crypto earnings are always have been subject to income tax and CGT in South Africa Normal income tax and CGT rules flexible enough to apply to crypto transactions Onus on taxpayers to declare crypto. Furthermore South Africa is in the top four of the 55 countries surveyed for their adoption of crypto. By this projection there will be approximately 4-million cryptocurrency users in South Africa by the end of 2023 which will mean that approximately 10 of South African adults may be using cryptocurrencies9 9 The 2016B AMPS survey estimated that there were 40-million South Africans. Crypto earnings are always have been subject to income tax and CGT in South Africa Normal income tax and CGT rules flexible enough to apply to crypto transactions Onus on taxpayers to declare crypto. The study illustrated that crypto-currencies are decentralised convertible virtual currencies that are based on cryptographic algorithms.

Source: pinterest.com

Source: pinterest.com

The study illustrated that crypto-currencies are decentralised convertible virtual currencies that are based on cryptographic algorithms. By this projection there will be approximately 4-million cryptocurrency users in South Africa by the end of 2023 which will mean that approximately 10 of South African adults may be using cryptocurrencies9 9 The 2016B AMPS survey estimated that there were 40-million South Africans. Crypto earnings are always have been subject to income tax and CGT in South Africa Normal income tax and CGT rules flexible enough to apply to crypto transactions Onus on taxpayers to declare crypto. The study illustrated that crypto-currencies are decentralised convertible virtual currencies that are based on cryptographic algorithms. According to a Statista Global Consumer Survey South Africa is among the top countries in terms of cryptocurrency ownerships with 178 percent of respondents indicating they owned or used crypto assets in 2020.

Source: pinterest.com

Source: pinterest.com

Crypto earnings are always have been subject to income tax and CGT in South Africa Normal income tax and CGT rules flexible enough to apply to crypto transactions Onus on taxpayers to declare crypto. According to a Statista Global Consumer Survey South Africa is among the top countries in terms of cryptocurrency ownerships with 178 percent of respondents indicating they owned or used crypto assets in 2020. Furthermore South Africa is in the top four of the 55 countries surveyed for their adoption of crypto. Regulatory frameworks of Canada the US and the EU with the legal position of crypto-currencies in South Africa. Crypto earnings are always have been subject to income tax and CGT in South Africa Normal income tax and CGT rules flexible enough to apply to crypto transactions Onus on taxpayers to declare crypto.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title cryptocurrency regulation south africa pdf by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.